Trust or trustees as shareholders

Can a trust or trustees be a shareholder of a company? Yes they can. However, under the Companies Act 2006, a company registered in England, Wales or Northern Ireland is not allowed to show that the shares are held by a trust or trustees on the company registers or in the information filed at Companies House. This restriction does not apply to companies registered in Scotland.

s.126 of the Companies Act 2006 states: “No notice of any trust, expressed, implied or constructive, shall be entered on the register of members of a company registered in England and Wales or Northern Ireland, or be receivable by the registrar.”

For more information about beneficial ownership in Kudocs, including UBO registers, see here.

Do I need to show that a trust/ trustee is a shareholder of a company? No, you are not allowed to, unless the company is registered in Scotland (where you can). For companies registered in England, Wales or Northern Ireland if the shares are held by a trust, you should record the trustee(s) as the shareholder(s). You cannot make any mention of the trust or that they are holding as trustees. If there are multiple trustees as shareholders, you can add them as joint shareholders (with the main shareholder being the ‘senior member‘).

You can, however, add details of the trust – that the shares are being held on behalf of beneficiaries – in Kudocs. This information is ‘Kudocs only’ – it will not appear in any company registers or in any Companies House filings, but will be available for internal use/ reference in Kudocs.

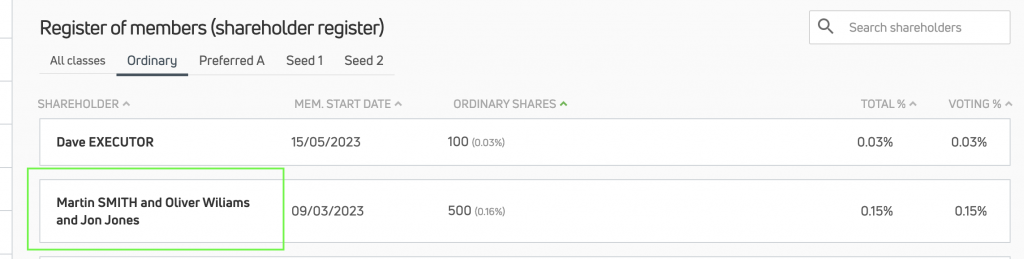

How do I record the details of shares being held on behalf of someone else (eg in a trust) in Kudocs? As you cannot show the details of a trust in the company registers or in Companies House filings, you should only record – as the shareholders – the details of the people holding the shares legally (ie the trustees), rather than beneficially. You do this in Kudocs by listing the legal owner(s) like any other shareholder. If there are multiple trustees as shareholders, you can add them as joint shareholders (with the main shareholder being the ‘senior member‘). You can also add details of the beneficiaries in Kudocs. This information is ‘Kudocs only’ – it will not appear in any company registers or in any Companies House filings, but will be available for internal use/ reference in Kudocs.

e.g. If the (imaginary) ‘Lewis Trust’ owns shares for various beneficiaries, you should not name the Lewis Trust (or that it is a trust) in the register of members. Instead, you should list the trustees of the trust as the legal owners, and then use Kudocs to record (as Kudocs-only information) that there is a trust and who the beneficiaries are – if you want to.

Can I incorporate a new company with a trustee as a shareholder? Yes you can, subject to the points above (i.e. you can’t show that they are holding the share on trust (unless it is a Scottish company). Often, their are multiple trustees – i.e. joint shareholders. For more information on incorporating a company with joint shareholders see here.

Can I use Kudocs to incorporate a company with trustees as subscriber shareholders? If so, how? Yes you can use Kudocs to do this, very easily.

The same principles apply: for companies registered in England and Wales, you cannot disclose that the trust is a shareholder. Therefore you need to add the details of the trustee(s) as the subscribers at incorporation.

There is a slight complication when there are multiple trustees because Companies House generally does not like incorporation applications where there are joint shareholders (e.g. if you have multiple trustees for 1 shareholder). For more information see here or get in touch with us.

For present purposes, the way round this is to add the details of the main legal shareholder as the subscriber in the incorporation. Once you have incorporated the company, you can edit the shareholder information in Kudocs to add details of (i) joint shareholders (if there are any); and (ii) beneficial owners. The next time the company files a confirmation statement, the joint shareholding will be filed at Companies House (but not the beneficiaries as that is not allowed on the public register, except in Scotland).

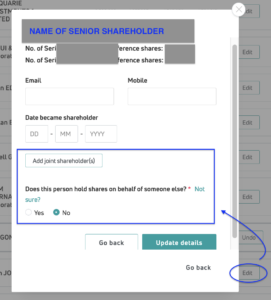

How do I add details of trustee shareholders and beneficiaries during onboarding? It is easy to do this using Full Onboarding. Just click {Edit} next to the shareholder’s name and then add details of the joint shareholders and any beneficiaries. The joint shareholding will be added to the registers in Kudocs and filed at Companies House (as is correct), but the beneficiary information will only be available inside Kudocs.

It does not matter if you do not add this information, or you complete Quick Onboarding (where you cannot edit shareholding information). You can always add joint/ beneficial shareholder information by editing the shareholder profile once onboarded.